Families will have to dig even deeper in 2011 as the VAT increase will add an average of £158 to household bills.

The increase from 17.5 per cent to 20 per cent, which comes in next Tuesday, will force up spending across the board - including essentials like water and electricity.

'Every single household will be affected in one way or another. Cutting back on luxuries is old news – now people need to cut their essentials.

'Following the joys of Christmas, consumers are going to be bought back to reality with a crash on January 4 as they see their bills go up.

'The good news is that there are ways to off-set this. The New Year‟s resolution on everyone‟s lips in 2011 should be to become more savvy and take better control of household finances.'

The increase from 17.5 per cent to 20 per cent, which comes in next Tuesday, will force up spending across the board - including essentials like water and electricity.

Most food is exempt, but it is payable on grocery items such as toothpaste and cleaning products, as well as sweets, drinks and snacks.

Big ticket items — such as televisions and washing machines — will become significantly more expensive.

The extra VAT would add £425 to a new £20,000 car, £106 to a £5,000 kitchen and £16 to a £750 TV.

The extra VAT would add £425 to a new £20,000 car, £106 to a £5,000 kitchen and £16 to a £750 TV.

Households will also be hit by a forgotten rise in Insurance Premium Tax — charged across all insurance products.

This will rise from 5 per cent to 6 per cent, adding £2.09 to the average buildings insurance policy and £1.11 to contents a year. Car insurance will also rise.

Ann Robinson, director of consumer policy at price comparison website uSwitch.com, said: 'Consumers can now put a value on what the VAT increase will mean for them and it‟s clear that the impact is going to spread far wider than just shoppers.

Big ticket items — such as televisions and washing machines — will become significantly more expensive.

VAT rise: TVs and washing machines will become significantly more expensive

Households will also be hit by a forgotten rise in Insurance Premium Tax — charged across all insurance products.

This will rise from 5 per cent to 6 per cent, adding £2.09 to the average buildings insurance policy and £1.11 to contents a year. Car insurance will also rise.

Ann Robinson, director of consumer policy at price comparison website uSwitch.com, said: 'Consumers can now put a value on what the VAT increase will mean for them and it‟s clear that the impact is going to spread far wider than just shoppers.

'Following the joys of Christmas, consumers are going to be bought back to reality with a crash on January 4 as they see their bills go up.

'The good news is that there are ways to off-set this. The New Year‟s resolution on everyone‟s lips in 2011 should be to become more savvy and take better control of household finances.'

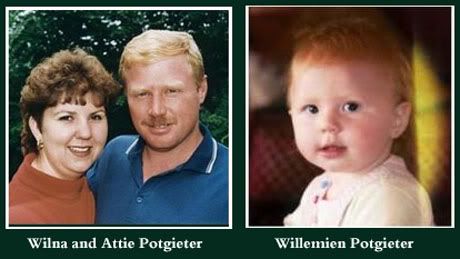

Ignored by the media and hidden from the world, which was encouraged to delight in the lovable Vuvuzela tooting black South Africans during the recent World Cup matches, the violent, racist, genocide of that country's white population continues apace.

Ignored by the media and hidden from the world, which was encouraged to delight in the lovable Vuvuzela tooting black South Africans during the recent World Cup matches, the violent, racist, genocide of that country's white population continues apace.

Marthie Erasmus, killed with a sledgehammer

Marthie Erasmus, killed with a sledgehammer